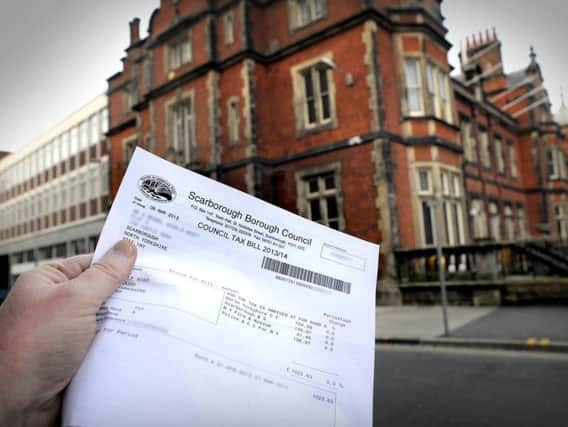

Here's what the average council tax bill is likely to be if you live in the Scarborough borough

With Scarborough Council due to set its budget on Friday, the full picture for ratepayers has become clear.

The borough authority, which makes up around 13% of a council tax bill, is proposing to increase its share of the precept by 2.99.%, or £6.82 a year for a Band D property.

Advertisement

Hide AdAdvertisement

Hide AdThis comes on the back of North Yorkshire County Council, which takes in 70% of a council tax payment, upping its share by 4.99% including the social care element, adding £62.31 a year to the average Band D bill.

Last week, Police and Crime Commissioner Julia Mulligan was “reluctantly” allowed to impose an inflation-busting 9.8% rise to her share of the bill by the North Yorkshire Police, Fire and Crime Panel – an extra £22.95 for a Band D property.

North Yorkshire Fire and Rescue Service will increase its share by 2.99% and those who live everywhere in the borough apart from Scarborough town centre will pay a town or parish council precept, which have gone up by an average of 3.96%.

That means that should Scarborough Council’s precept increase be approved a Band D property owner in the borough will be paying £1,896.08 in 2019/20.

This is an increase of £95.03 on the same property the previous year, a rise of 5.28%.